how much is inheritance tax in wv

WV has no inheritance or estate taxSo the answer is 0. Monday February 24th 2020 708 pm.

What Is Inheritance Tax Probate Advance

A Guide to West Virginia Inheritance Laws.

. There are 38 states in the. Some states and a handful of federal governments around the world levy this tax. Do I have to pay taxes on a 10 000 inheritance.

As of 2021 the six states that charge an inheritance tax are. Effective Jan 1 2013 if Congress does nothing about the federal estate tax then the tax will return to the status that. If you are considering your estate plan or have recently received an inheritance and need more information contact me Anna M.

How Much Is the Inheritance Tax. A full-year resident of West Virginia A. Price at Jenkins Fenstermaker PLLC by.

The first 1000 is exempt. 304 558-3333 or 800 982-8297 Contact Us Phone Directory Site Map You are about to open a link to the website of another organization. Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law.

The tax rate on. The tax rate varies. As previously mentioned the amount you owe depends on your relationship to the deceased.

Heres a breakdown of each states inheritance tax rate ranges. Use the IT-140 form if you are. Inheritance tax is imposed on the assets inherited from a deceased person.

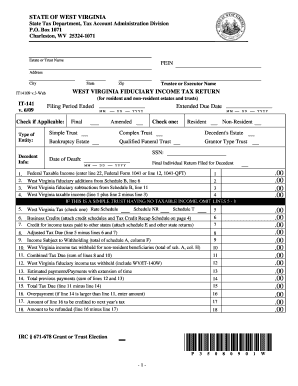

IT-140 West Virginia Personal Income Tax Return 2021. Inheritance tax rates vary widely. Fillable-Forms Forms and Instructions Booklet Prior Year Forms.

In Washington State there is no inheritance tax. Berkeley Springs WV 25411. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from 18 to 40.

When you go through probate administration its important to keep in mind the specific state laws for taxes and seek legal advice. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Tax Information and Assistance.

There can be two kinds of death taxes inheritance taxes and estate. As of 2021 only estates worth more than 117 million are taxed and only on the amount that exceeds that number. How Much Is the Inheritance Tax.

Like most states there is no West Virginia inheritance tax. There is no federal inheritance tax but there is a federal estate tax. Kentucky Extended family pays from 4 percent on inheritances valued at 10000 up to 16 percent on those above 200000 with eight margins in between.

Although West Virginia has neither an estate tax or nor an inheritance tax the. Based on the value of the estate 18 to 40 federal estate. Inheritance tax rates differ by the state.

West Virginia Inheritance Tax Laws.

A Short Guide To West Virginia Inheritance Tax Blog Jenkins Fenstermaker Pllc

New Jersey Estate Tax Changes Mccarthy Weidler Pc

Wv State Tax Department Fiduciary Estate Tax Return Forms Fill Out And Sign Printable Pdf Template Signnow

Taxing The Rich The New York Times

West Virginia Estate Tax Everything You Need To Know Smartasset

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

The Wealthy Now Have More Time To Avoid Estate Taxes

Mineral Rights In West Virginia Lease Buy Or Sell In Wv Pheasant Energy

/state-no-estate-tax-2000-654db88bef32439ab403da6132265b5a.jpg)

States With No Estate Or Inheritance Taxes

West Virginia Estate Tax Everything You Need To Know Smartasset

Estate And Inheritance Taxes By State In 2021 The Motley Fool

The Ultimate Guide To West Virginia Real Estate Taxes

Tsd393 State Wv Us Taxrev Taxdoc Tsd

Us Inheritance Tax Leave Property For Children List Of 13 States And Territories That Impose Inheritance Tax In The United States 2020 Edition American Life Insurance Guide

Complete Guide To Probate In West Virginia

Creating Racially And Economically Equitable Tax Policy In The South Itep

West Virginia Estate Plan Facebook

State By State Estate And Inheritance Tax Rates Everplans

Pdf The Federal Estate Tax History Law And Economics Semantic Scholar